Faster and easier way for traditional SMEs to sell online with Kiple

Jan 21, 2021

The year 2020 had brought an immense amount of change for many, particularly Small and Medium Enterprises (SMEs) in the country. Representing approximately 98% of business establishments in Malaysia, these SMEs who had historically been great contributors to the nation’s GDP were suddenly faced with the inability to operate in a ‘new normal’ that they were not ready to manage.

By taking the leap from traditional selling methods to digital platforms, many had to pivot to ensure their businesses could survive and thrive. Now, as the country enters its second Movement Control Order (MCO), digital solutions have become a necessity for those wanting to grow in this new business landscape and here’s where fintech specialist Kiple has stepped in to provide SMEs with the means to adopt simple, effective digital tools in kickstarting their digital transformation.

Helping SMEs sell and receive payments online seamlessly

As part of internationally recognised Green Packet Berhad, Kiple has been enriching the lives of its customers through digital solutions and experiences. Built on the foundations of Green Packet Berhad’s two decades of telecommunications and technology expertise in Malaysia, Kiple is in the position to analyse, evaluate and consult SMEs on the necessary steps needed to start their digital journey.

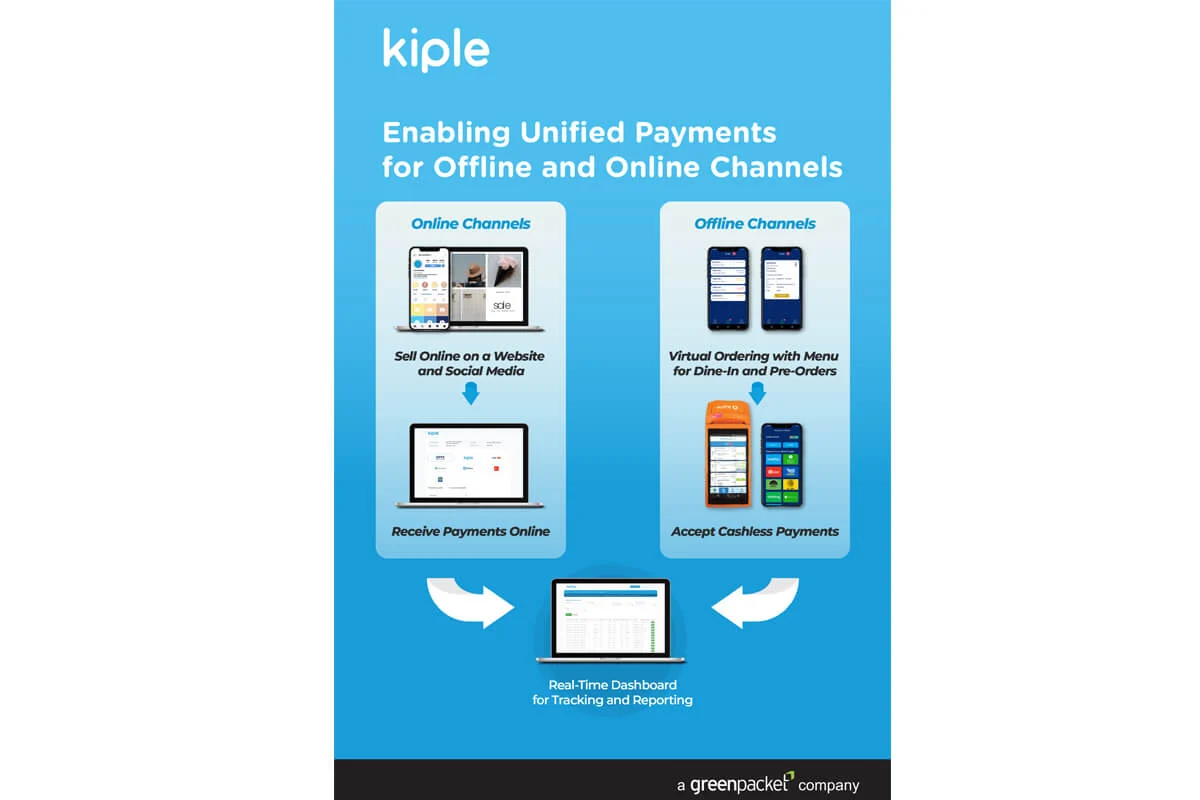

Kiple understands that not every business comes prepared with a well-established online platform, e-commerce site or payment solution, and has thus conceptualised these solutions under Kiple Unified Payments to help SMEs transition into the online marketplace, which are:

• 1-Click Payment, an end-to-end solution to help SMEs take their businesses online, and

• Integrated Payment Gateway to assist SMEs in organising a fully customisable online payment facility.

The first solution utilises simple, consumer-accessible platforms such as Facebook, Instagram and even Whatsapp to help SMEs sell their offerings. The 1-Click Payment provides SMEs the ability to:

• Customise a simple, user friendly interface - this enables the SME to display their products for sale, supplemented with relevant descriptions and other necessary information

• Automate the process of receiving orders and payments digitally - customers can pay through e-wallets, debit/credit card payment or FPX transfer

• Manage cashflow - Kiple will process all settlements within T+2 Days regardless of payment method

• Manage transactions - Authorised personnel can view a summary of transactions made and track the status of payments for ease of record and accounting in the future

The second solution is the Integrated Payment Gateway, which is designed for merchants who want to organise a fully customisable payment facility with ease. This does away with the hassle of tracking and following up with payments, issues related to cashflow due to the inability of customers to complete payment and reduces the need for face-to-face payments - especially in this climate with various social distancing measures in place. Its features include:

• Electronic know-your-customer (eKYC) management

• Online and in-store payments

• QR payments

• Money transfer

• Voucher generation and redemption

• Loyalty and card management

The app can be integrated with the merchant’s existing website or application to allow their customers to make payments digitally, and address issues related to cashflow.

Accessible via computer or any smartphone, these comprehensive Kiple solutions provides flexibility and convenience for merchants who are able to access and monitor their business anytime, anywhere.

Supporting SMEs with reliable integrated payment solutions in the ‘new normal’

One such example of an organisation that Kiple has helped transform is AOneSchools, a management system provider for learning institutes including kindergartens, schools as well as tuition and enrichment centres.

When the first MCO came into effect in early 2020, Dr Darren Gouk, the founder and CEO of AOneSchools realised that their client base faced a plethora of challenges, managing student payment and company cashflow being the biggest.

Parents of the students were not able to make payment due to financial constraints, causing payments to be delayed by several months and severely impacting the institutes’ ability to operate.

Whilst searching for a solution to these predicaments, Dr Darren came across Kiple’s Integrated Payment Gateway which allowed seamless integration of online and offline payments into the AOneSchools app for ease of the learning institutes and their respective customers. With the streamlining of their processes and simplification of monthly billing, there was a significant positive effect on cashflow.

“Digitalising is no longer something that is ‘good to have’, but it is now a necessity to survive. Previously, e-learning was a new way of learning and educating students, but it is now the only progressive method they can use in light of the current situation. What’s great is there’s never been a better time to go digital, as the government is currently providing significant aid to SMEs to transform how they do business. For instance, the SME Digitalisation Grant provides SMEs with a 50% rebate on digital tools - AOneSchools is one of those recognised tools and we are truly appreciative of partners like Kiple, who share our belief in enriching communities and inspiring change through technology,” shares Dr Darren.

Weathering the economic storm with digital reinforcements, together

Despite seeing some positive developments over the past few months, we Malaysians have not fully cleared the turbulent waters and with the recently imposed MCO 2.0, more challenges remain at the horizon for all businesses.

Kay Tan, CEO of Kiple recognises this by saying, “Since the introduction of Kiple, we have been successful in catalysing the digitalisation process for SMEs nationwide, which is actually very symbolic as this also coincides with the recent 20th anniversary milestones of our parent company, Green Packet. Whilst we are very happy to have reached both these achievements, we also realise that we are just getting started and we are in a constant race against time to help SMEs adapt and become truly sustainable in the marketplace of today.”

“Digitalisation is crucial for this sustainability and the regeneration of local and global economy, so if you’re a business owner just embarking on this journey, then know that we have the tools, technology and people to help you get started immediately!”

At Green Packet, for 20 years we make the best of innovations accessible to all, making the impossible, possible.

Learn more about our solutions at 20years.greenpacket.com